Tax-Small Business

Our tips and tricks to get you on track

If you own or manage a business with employees, there’s a harsh tax penalty that you could be at risk for paying personally. The Trust Fund Recovery Penalty (TFRP) applies to Social Security and income taxes that are withheld by a business from its employees’ wages. Sweeping penalty The TFRP is dangerous because it applies…

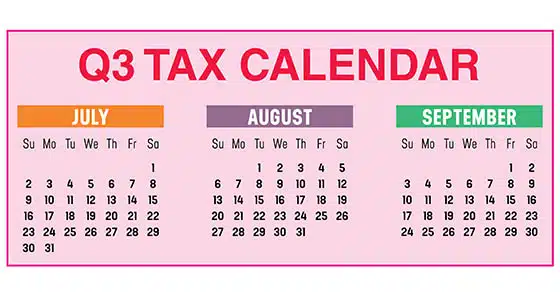

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July…

Your business may be able to claim big first-year depreciation tax deductions for eligible real estate expenditures rather than depreciate them over several years. But should you? It’s not as simple as it may seem. Qualified improvement property For qualifying assets placed in service in tax years beginning in 2023, the maximum allowable first-year Section…

If you and your employees are traveling for business this summer, there are a number of considerations to keep in mind. Under tax law, in order to claim deductions, you must meet certain requirements for out-of-town business travel within the United States. The rules apply if the business conducted reasonably requires an overnight stay. Note:…

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting…

The IRS recently released guidance providing the 2024 inflation-adjusted amounts for Health Savings Accounts (HSAs). HSA fundamentals An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of an “account beneficiary.” An HSA can only be established for the benefit of an “eligible individual” who is covered…