Posts

Our tips and tricks to get you on track

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In Notice 2023-68, the IRS announced the fiscal 2024 special “per diem” rates that became effective…

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basic details The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed…

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle.…

Ever wonder how IRS examiners know about different industries so they can audit various businesses? They generally do research about specific industries and issues on tax returns by using IRS Audit Techniques Guides (ATGs). A little-known fact is that these guides are available to the public on the IRS website. In other words, your business…

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general…

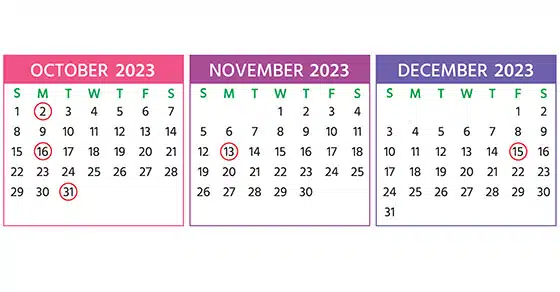

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note:…